Case Study: Milwaukee Tool

One company engaging in a number of questionable practices is Milwaukee Tool.

This company, with an iconic American name, isn’t American at all. It is owned by Hong Kong-based Techtronic Industries (TTI).

Likely few U.S. consumers realize that Milwaukee Tool is actually a Chinese company, along with other TTI “American” brands including Hoover, Dirt Devil, Oreck, and others.

It is difficult for consumers to keep track of when legacy American brands are purchased by foreign companies. It is likely that consumers discern only differences in prices, which can be significant with some foreign companies’ labor and operational practices.

If only masquerading as “American” were the only issue with TTI’s business practices.

The Evidence

The Trade Alliance to Promote Prosperity (TAPP) believes TTI should be investigated for possible trade violations, based on data analysis conducted by TAPP and supported by information from Exiger.¹

In a sample of 2,209 publicly available commercial records analyzed by Exiger, researchers found that 91% of Milwaukee/TTI shipments, by value, were not subject to 301 tariffs.²

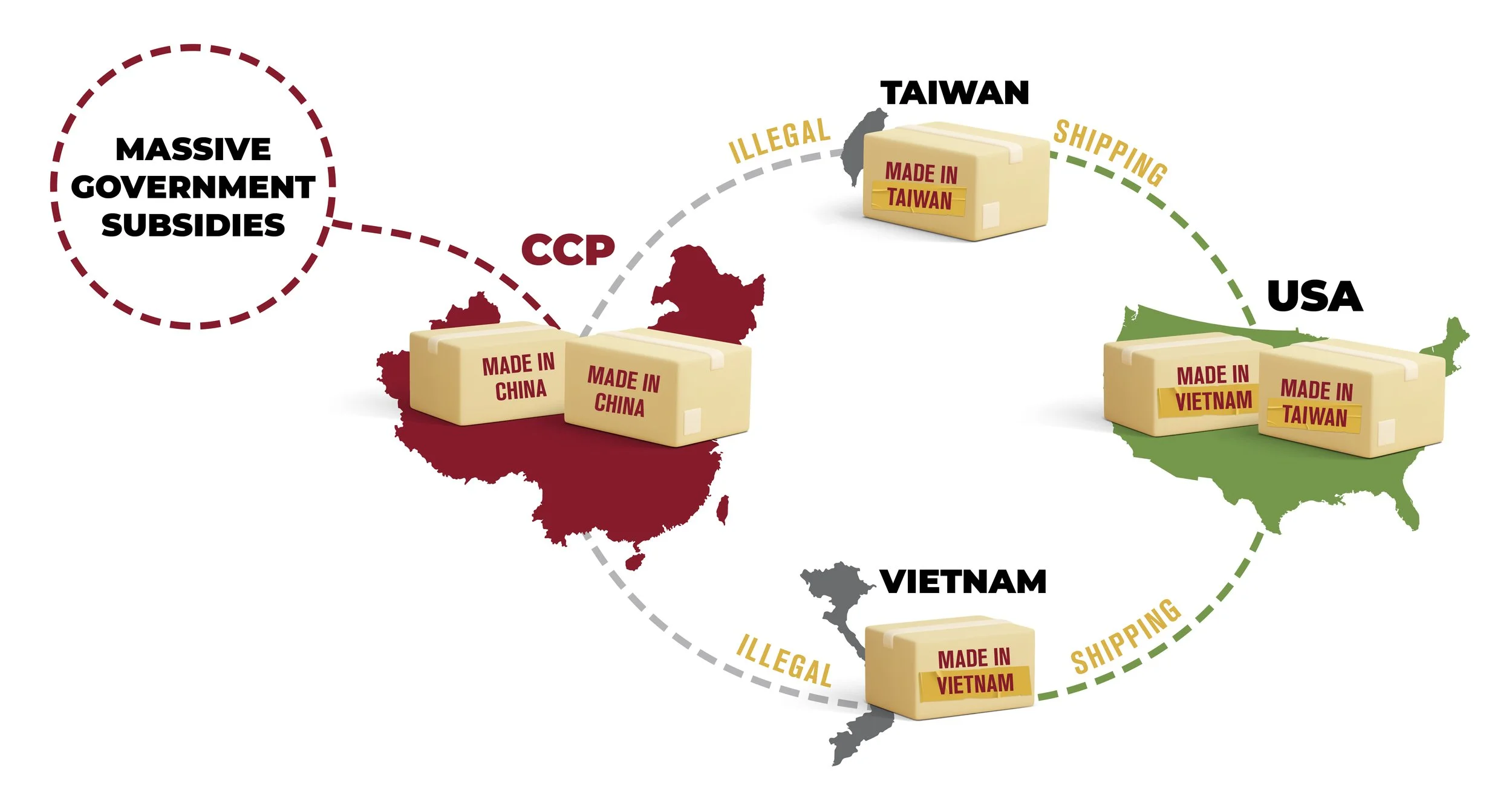

Approximately 7% of all analyzed Milwaukee/TTI imports to the United States came from TTI Taiwan,³ despite TTI having no manufacturing presence in Taiwan.⁴ All of these shipments ($30.5 million) would be subject to Section 301 tariffs if China were the true country of origin.⁵ This raises the question of whether TTI is engaging in transshipment through Taiwan and should be investigated.

Additionally, Milwaukee/TTI’s Vietnam-US import volume was nearly double (1.8 times) that of its China-US volume, even though the company has the same number of factories in each country and its largest manufacturing hub is in mainland China.⁶

It’s possible that TTI is operating above board and all of this stems from legitimate supply chain engineering, but ample evidence suggests an investigation is warranted.

Moreover, there is enough concern around other TTI business practices to cast doubt on the propriety of the company’s international trade dealings, as well.

For example, Milwaukee Tool has been in the spotlight recently, with several news outlets reporting that the company is being sued for using forced prison labor in its manufacturing facilities in China. If true, then clearly the use of forced prison labor would create an opportunity for Milwaukee Tool to undercut American companies that abide by ethical labor practices.

Other Concerns

TTI’s ties to the Chinese Communist Party and government officials raise a number of questions and could afford the company and its subsidiary, Milwaukee Tool, unfair advantages in the marketplace. This possibility should be investigated.

Because of its ownership by a Chinese company, Milwaukee Tool could be benefiting from direct relationships with suppliers that are Chinese state-owned enterprises, possibly in lower costs and more stable supply chains than Western competitors enjoy.

Chinese universities often have strong ties to the state and to the military, receiving government funding aligned with Chinese Communist Party goals and supporting strategic sectors through state-sponsored programs. These relationships facilitate collaborations with state-owned enterprises and enhance R&D in technologies critical to China’s industrial and military priorities.⁸ The connection of TTI executives to Chinese universities, such as Shenzhen Technology University, underscores the strategic benefits, including possible access to skilled personnel, funding, and accelerated innovation, ultimately contributing to a competitive edge in the market.

TTI’s executives have held influential positions in Chinese industry, including to powerful industry groups connected to the Chinese government. This kind of relationship could grant TTI access to state-backed Chinese business networks and may also secure the company favorable regulatory treatment.

A short seller’s allegations of manipulative accounting and potential fraud at TTI, supported by detailed financial analysis and open-source evidence, may indicate that Chinese authorities are shielding and/or financially backing TTI.

Beyond the economic issues, there might be national security issues at play.

Milwaukee Tool products’ use of geolocation data could pose risks to US national security, especially for critical infrastructure projects and military operations, as part of China’s Military-Civil Fusion strategy.

According to the Lexology archive, in a news item from Phillips Lytle LLP, on January 19, 2017, Milwaukee Tool agreed to settle with the US Department of Commerce by paying $301,000 as a result of 25 occasions, ranging from 2012 to 2014, in which Milwaukee Tool exported thermal imaging cameras to various jurisdictions, including Hong Kong, without required export licenses. The products are controlled for national security reasons.

Recent Developments

On September 23, 2024, the Trade Alliance to Promote Prosperity wrote to the House Select Committee on the CCP and the Congressional-Executive Commission on China to request the opening of an investigation of Milwaukee Tool for potential Section 301 tariff violations regarding imports from China. In the letter, TAPP wrote, "We believe the evidence at hand raises serious questions about tariff integrity and TTI’s international trade presence." Read the letter here.

In the Media

Real Clear Defense: Trump's Tariffs – History Has Lessons To Be Followed

Real Clear Policy: Conservatives Hope Trump Tariff Announcement Leverages Better Trade Deals

WWTC AM "The Patriot" Radio: Jack Tomczak Show - Not Actually Made in America

Wall Street Journal – Milwaukee Tool Sued Over Alleged Chinese Forced Labor in Supply Chain

PBS Wisconsin – A lawsuit argues Milwaukee Tool relied on forced labor in China to make gloves

Wisconsin Public Radio – Milwaukee Tool sued for allegedly using Chinese forced prison labor

Wisconsin Watch – Lawsuit: Milwaukee Tool relied on forced Chinese prison labor to make gloves

Law 360 – Milwaukee Tool Accused Of Selling Gloves Made By Prisoners

Milwaukee Journal Sentinel – Milwaukee Tool sued for alleged use of forced labor in Chinese prison factory

Biz Times Milwaukee Business News – Milwaukee Tool facing lawsuit over alleged use of forced labor to make gloves

Lexology Phillips Lytle LLP – BIS Accepts $301,000 to Settle Penalty for Unlicensed Exports of Thermal Imaging Cameras

Reuters – US lawmakers question Techtronic's Milwaukee Tool on alleged links to forced labor

Supply Chain Brain – Milwaukee Tool Questioned Over Forced Labor Allegations

PBS Wisconsin – Chinese prisoners say forced labor has been used to manufacture Milwaukee Tool gloves

Milwaukee Journal Sentinel – Congress asks Milwaukee Tool for answers on human rights in China. Here are takeaways from a hearing Tuesday.

Urban Milwaukee – Milwaukee Tool Sued For Allegedly Using Forced Prison Labor

Wisconsin Watch – Chinese prisoners: We were forced to make Milwaukee Tool gloves for cents each day

Nikkei Asia – Milwaukee Tool sued for alleged Chinese forced labor

Wisconsin Watch – Walmart pulls Milwaukee Tool gloves allegedly made by Chinese prisoners

Slash Gear – Are Ryobi and Milwaukee Tools Made in the Same Factory?

Wisconsin Watch – Why I investigated Milwaukee Tool work gloves — and what we learned

National Review – Congress Investigates Milwaukee Tool over Forced Labor Allegations

Note on Research

Tariff Integrity constantly engages in research to update the accuracy of its content. Periodic changes to the content of the website reflect its most recent research.

What You Can Do to Help

Ask the U.S. Trade Representative to crack down on China and to fight for tariff integrity.

Sign Our Petition

¹ In a document, Supply Chain Review, dated February 3, 2023, analyzing and reporting on findings from data collected and visualized DDIQ-Analytics dashboard), Exiger provided analysis of TTI/Milwaukee Tool buyer supplier relationships from 2017-22. Supporting data sources included S&P Panjiva (global shipping records from bills of lading and customs declarations) and FactSet corporate disclosures (regulatory and discretionary). The review also considered corporate ownership data (from, e.g., Bureau van Dijk or BvD) to identify the corporate families of TTI and TTI suppliers. The analysis focused on direct and indirect shipments to the TTI corporate family and its known suppliers. “Indirect” denoted potential exposure to suppliers or shipments one tier upstream through an intermediary entity. In querying billions of shipping records to support this analysis, Exiger applied data filters to isolate shipments most likely to be associated with power tools (e.g., hammer drill, compact drill, handed reciprocating saw, compact reciprocating saw, grinder) as well as related raw materials and components. Component and part descriptions were used to identify relevant keywords pertaining to the power tools (e.g., “hammer, ” motor”) while excluding less descriptive keywords (e.g., “bag, “label”).

² Based on Exiger’s analysis of international commerce records, including U.S. import and export manifests, which provide detailed information on shipments entering and leaving the United States and other countries. Data was drawn from S&P Panjiva, which sources bills of lading from U.S. Customs and Border Protection. Exiger also analyzed customs declarations from Panjiva as well as ImportGenius and Market Inside. Analysis focused on shipments spanning June 1, 2022, to March 1, 2024. Exiger queried the commerce dataset in the noted time period based on 325 relevant headings under the World Customs Organization (WCO) 2022 Harmonized System Nomenclature. The Harmonized System Code (HSC) is a global standard used by all countries. The Harmonized Tariff System (HTS) is the U.S. implementation of the WCO’s broader international Harmonized System; the HTS expands the numerical classifications tagged to international shipments by adding digits to provide more detailed classifications of products specific to U.S. tariffs and trade regulations. These overlapping rules, classifications, and standards are meant to ensure consistent product classification for customs purposes, determining tariffs, and tracking trade statistics. Querying the commerce dataset within these parameters yielded 2,209 records (i.e., shipments). This was a statistically significant population with a 99% level of confidence level — +/- a 3% margin of error — if the redacted (or “manifest confidentiality”) population follows a similar distribution. In that regard, analysis of the above dataset found that 79% of Milwaukee/TTI China-US imports lacked shipment values, suggesting that the company obscures its Chinese imports by requesting manifest confidentiality from the US government. Separately, Exiger used the following data fields to determine country of origin to estimate Section 301 tariff impact (in priority order): (1) place of receipt (i.e., country where carrier took receipt of goods); (2) port of lading (i.e., country where goods loaded onto vessel); (3) shipment origin (i.e., final international port of call before arrival in US); and (4) shipper country (i.e., jurisdiction of shipper’s legal entity).

³ Analysis of commerce dataset detailed in the previous footnote.

⁴ Analysis of commerce dataset detailed in footnote 1 and of Section 301 tariff rules published by US Trade Representative, https://ustr.gov/issue-areas/enforcement/section-301-investigations/search.

⁵ Analysis of shipment country of origin in dataset detailed in footnote 1.

⁶ Open-source research using TTI website, https://www.ttigroup.com/contacts/tti-oYices, and TTI regulatory disclosures. See also Forbes, Power Player: Billionaire’s Bold Bets During The Pandemic Paid Off Big, Dec. 14, 2022 (“As the pandemic unfolded, the news was grim from both TTI’s biggest customer, Home Depot, and its biggest factory in Dongguan, China.”).

⁷ Analysis of commerce dataset detailed in footnote 1.

⁸ Xue, Lan. (2004). University-Market Linkages in China: the Case of University-Affiliated Enterprises.